child tax credit portal phone number

800-908-4184 is the direct phone number specifically for questions or help with the child tax credit. Connecticut State Department of Revenue Services.

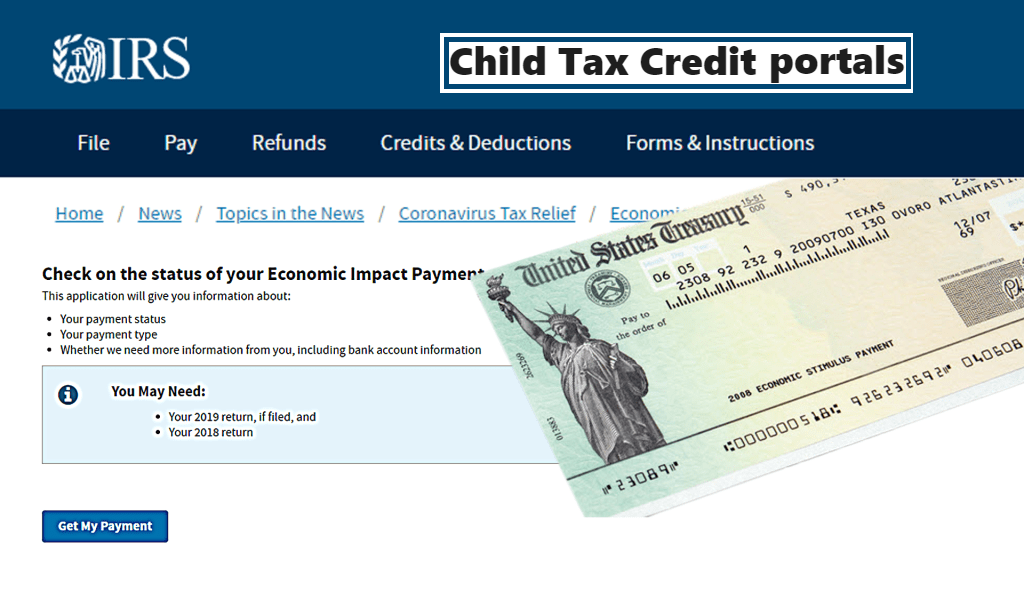

Irs Adds Address Change Capability To Child Tax Credit Portal Nstp

Choose the location nearest to you and select Make Appointment.

. Learn about the child tax credit which will help you to claim tax credit for children under the age of 18. Find answers about advance payments of the 2021 Child Tax Credit. The credit amount was increased for 2021.

It is a tax law resource that takes you through a series of questions and provides you with responses. For all other tax law inquiries visit the Interactive Tax Assistant on irsgov. The amount you can get depends on how many children youve got and whether youre.

The number to try is 1-800-829-1040. They can only answer. Making a new claim for Child Tax Credit.

Call the IRS about your child tax credit questions from the below phone number. 1-800-829-1040 Regardless of the state you live in the IRS representatives are available Monday through Friday. Many families received advance payments of the Child Tax Credit in 2021.

Heres the Direct phone number for CTC questions or help. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Closed weekends and bank holidays.

You can also find out information in. IMPORTANT INFORMATION - for filers of the following tax types. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

You can see your advance payments total in. Due to a change to the federal credit working families. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased.

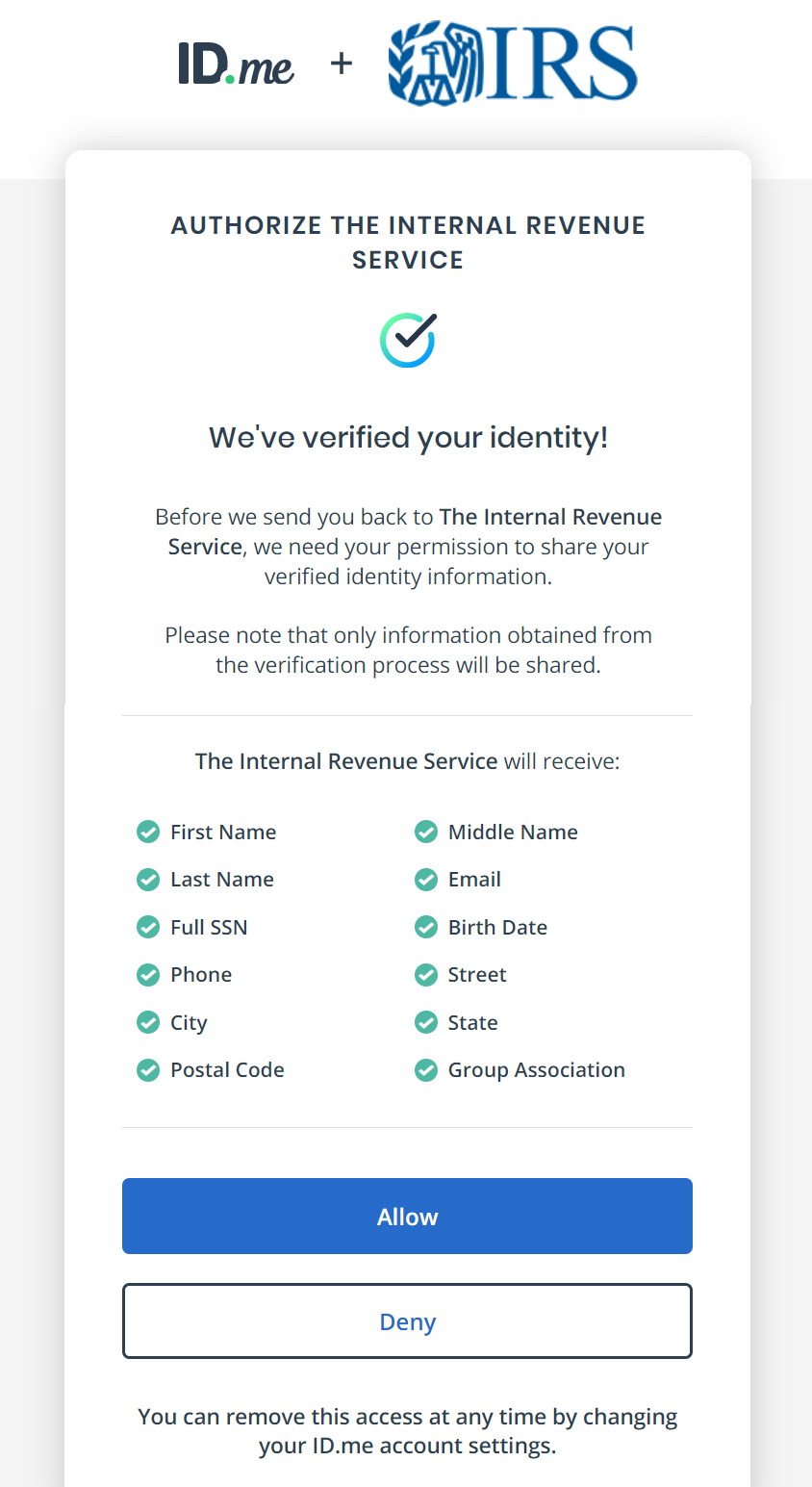

If you have oneClick this link to see the Child Tax Credit Update Portal. If you had an issue with a child tax credit payment that wasnt resolved there are a few ways to contact the IRS. The federal Child and Dependent Care Credit helps families pay for child care for children under age 13 or for care of dependent adults.

Our phone line opening hours are. Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming phone calls. Have been a US.

Already claiming Child Tax Credit. Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. Department of Revenue Services.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. If you dont have internet access or cant use the online tool you can unenroll by contacting the IRS at the phone number on your Advance Child Tax Credit Outreach Letter you.

44 2890 538 192.

Change Address On Child Tax Credit Update Portal Taxing Subjects

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Rpsd Blog Raton Public Schools

Child Tax Credit Irs New Online Portal Help Families Plan Ahead In Payments

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

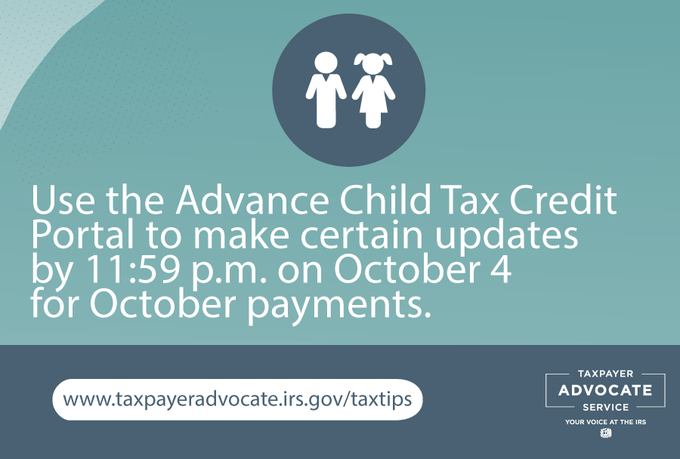

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Online Portal Ensures All Who Qualify Can Get Child Tax Credit 12newsnow Com

Irs Opens Child Tax Credit Portal How To Check If You Re Getting 300 Monthly Payments Syracuse Com

Irs Adds Address Change Capability To Child Tax Credit Portal Where S My Refund Tax News Information

Ct Child Tax Rebate Deadline July Local Places Near Me

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Launches New Online Tool To Help Manage Child Tax Credit Nextadvisor With Time